Hankook Tire has established itself as a dominant force in the global commercial tire market, particularly in the truck and bus radial (TBR) segment. With an annual production capacity exceeding 100 million tires and TBR tires accounting for approximately 25% of total output, Hankook has secured its position among the top seven tire manufacturers worldwide, commanding a 5.2% market share in the global commercial tire sector as of 2024. This article provides an in-depth analysis of Hankook’s truck tire operations, including its manufacturing capabilities, product portfolio, technological innovations, market strategies, and future outlook, supported by extensive data and market research.

Historical Growth and Financial Performance

Founded in 1941, Hankook Tire has evolved from a small Korean enterprise to a global tire powerhouse. The company’s financial trajectory demonstrates remarkable growth, with 2007 marking a significant milestone when it achieved $174 million in profits and $7 billion in sales, propelling it from the 11th to the 6th position in global tire manufacturer rankings. This upward trend has continued, with Hankook maintaining consistent revenue growth through strategic expansions and technological investments.

Hankook operates an extensive network of state-of-the-art production facilities strategically located to serve key markets:

– Daejeon, South Korea: The flagship manufacturing and R&D hub, responsible for premium tire lines and technological innovation

– Chongqing, China: A massive production base specializing in TBR tires for Asian markets, with annual capacity exceeding 15 million units

– Clarksville, Tennessee, USA: A $1.8 billion facility serving North American markets with 12 million tire capacity annually

– Rácalmás, Hungary: European production center supplying 19 million tires yearly to EU markets

– Cikarang, Indonesia: Southeast Asian hub with 9 million tire capacity focusing on emerging markets

Market share analysis

Hankook’s market penetration varies significantly by region:

– Global: 5.2% share in commercial tires (2024)

– North America: 8% of truck tire market (key clients include FedEx and UPS fleets)

– China: 12% market share with 6% annual growth in TBR segment

– South Korea: Dominates domestic market with around 30% share

– Europe: Strong presence in Germany, UK and France with 6% Year on Year growth

Comprehensive TBR Product Line

Hankook’s truck tire offerings are segmented by application and performance characteristics:

Long-Haul/Highway Tires

– SmartFlex AL11: Premium fuel-efficient tire with 18% longer tread life than industry average

– AH31 (All-Position): Versatile tire with 15% better wet braking performance

Regional/Urban Delivery Tires

– SmartFlex DL11: Optimized for stop-and-go traffic with reinforced sidewalls

– AM35 (Mixed Service): All-season performer with 20% better winter traction

Special Application Tires

– SmartWork DW11: Construction/off-road tire with cut-resistant compound

– Winter iPike RW11: Studdable winter tire for extreme conditions

| Brand | SIZE | PR | PATTERN |

| Hankook | 8R22.5 | 14 | AH33 |

| Hankook | 9R22.5 | 14 | AH33 |

| Hankook | 9R22.5 | 16 | AU05 |

| Hankook | 10R22.5 | 16 | AH33 |

| Hankook | 10R22.5 | 16 | AU05 |

| Hankook | 11R22.5 | 16 | AH30 |

| Hankook | 11R22.5 | 16 | AH31 |

| Hankook | 11R225 | 16 | AH33 |

| Hankook | 11R22.5 | 16 | AL26 |

| Hankook | 11R22.5 | 18 | AU05 |

| Hankook | 12R22.5 | 18 | AH19 |

| Hankook | 12R22.5 | 18 | AH30 |

| Hankook | 12R22.5 | 18 | AH89 |

| Hankook | 12R22.5 | 18 | AL26 |

| Hankook | 12R22.5 | 18 | AM09 |

| Hankook | 12R22.5 | 18 | DH81+ |

| Hankook | 12R22.5 | 18 | TH31 |

| Hankook | 12R22.5 | 12 | TH31 |

| Hankook | 13R22.5 | 18 | AM09 |

| Hankook | 13R22.5 | 18 | DM09 |

| Hankook | 9.5R17.5 | 16 | AH35 |

| Hankook | 9.5R17.5 | 18 | TH31 |

| Hankook | 205/65R17.5 | 18 | TH31 |

| Hankook | 205/75R17.5 | 12 | AH35 |

| Hankook | 215/75R17.5 | 16 | AH35 |

| Hankook | 215/75R17.5 | 16 | TH31 |

| Hankook | 225/70R19.5 | 14 | AH35 |

| Hankook | 235/75R17.5 | 16 | AH35 |

| Hankook | 235/75R17.5 | 18 | TH31 |

| Hankook | 245/70R17.5 | 18 | TH31 |

| Hankook | 245/70R19.5 | 18 | AH35 |

| Hankook | 245/70R19.5 | 18 | AU06 |

| Hankook | 245/70R19.5 | 18 | TH31 |

| Hankook | 255/70R22.5 | 16 | AH37 |

| Hankook | 255/70R22.5 | 16 | AU05 |

| Hankook | 265/70R19.5 | 14 | AH35 |

| Hankook | 265/70R19.5 | 18 | AU06 |

| Hankook | 265/70R19.5 | 18 | TH31 |

| Hankook | 275/70R22.5 | 16 | AH31 |

| Hankook | 275/70R22.5 | 18 | AH37 |

| Hankook | 275/70R22.5 | 16 | TH31 |

| Hankook | 275/80R22.5 | 16 | AH31 |

| Hankook | 285/70R19.5 | 18 | TH31 |

| Hankook | 295/60R22.5 | 18 | TH31 |

| Hankook | 295/80R22.5 | 18 | AH31 |

| Hankook | 295/80R22.5 | 18 | AH33 |

| Hankook | 295/80R22.5 | 18 | AL22 |

| Hankook | 295/80R22.5 | 18 | AL51 |

| Hankook | 295/80R22.5 | 18 | AU05 |

| Hankook | 295/80R22.5 | 18 | DL51 |

| Hankook | 305/70R22.5 | 20 | AU05 |

| Hankook | 315/60R22.5 | 20 | AH31 |

| Hankook | 315/60R22.5 | 16 | DH31 |

| Hankook | 315/70R22.5 | 20 | AH31 |

| Hankook | 315/70R22.5 | 18 | DH31 |

| Hankook | 315/80R22.5 | 20 | AH33 |

| Hankook | 385/55R22.5 | 18 | AH31 |

| Hankook | 385/55R22.5 | 18 | TH31 |

| Hankook | 385/65R22.5 | 24 | AH31 |

| Hankook | 385/65R22.5 | 24 | TH31 |

| Hankook | 425/65R22.5 | 20 | TH31 |

| Hankook | 825R16 | 18 | AH30 |

| Hankook | 825R20 | 16 | AH30 |

| Hankook | 900R20 | 16 | AH30 |

| Hankook | 1000R20 | 18 | AH30 |

| Hankook | 1000R20 | 16 | AM81 |

| Hankook | 1100R20 | 16 | AH30 |

| Hankook | 1100R20 | 16 | AM81 |

| Hankook | 1200R20 | 18 | AM81 |

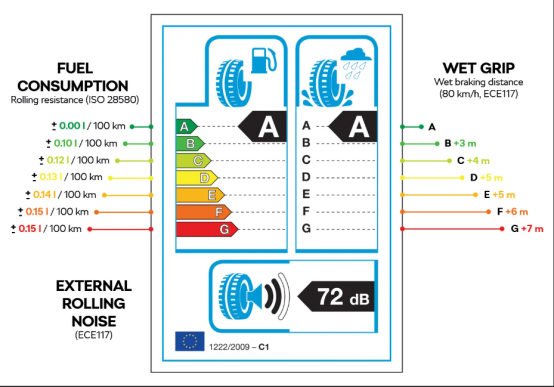

1.Are those tire equipped with EU labeling?

Click the link to check what is EU tire label

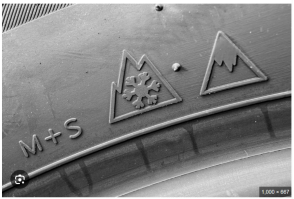

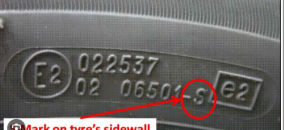

2. Are you able to identify following information on tire sidewall?

3.Do you have a reliable supplier to support you?

This question, you will need to find answer by yourself. You can trust TNR, a tire company have good reputation in tire industry over 15 years.

Hankook invests approximately 5% of annual revenue ($350+ million) in R&D across five global centers, focusing on:

Material Science Innovations

-Nano-silica compound technology improving wet grip by 12%

– Aramid fiber reinforcement enhancing durability under heavy loads

– Sustainable materials comprising 35% of new product formulations

Performance Technologies

– i-Flex Run-Flat System allowing 50+ miles at 50 mph after puncture

– Variable Pitch Sequence technology reducing road noise by 3dB

– 3D siping and groove designs optimizing all-weather performance

Smart Tire Solutions

– Embedded sensors for real-time pressure/temperature monitoring

– RFID tracking for fleet management integration

– Predictive tread wear analytics through AI algorithms

OEM Partnerships

Hankook has secured original equipment positions with:

– Commercial Vehicles: Hyundai, Daimler Trucks, Volvo, MAN (30+% of TBR sales)

– Performance Vehicles: BMW, Mercedes-AMG (demonstrating technical capability)

– Emerging EV Market: BYD, Tesla Semi (developing specialized EV truck tires)

Aftermarket Distribution

The company maintains a robust global distribution network:

– North America: 5 regional distribution centers serving 15,000+ retail points

– Europe: Partnership with ATU (1,200+ service centers) and independent dealers

– Asia: Direct sales to major fleets and franchise retail chains

Fleet Services

Hankook offers comprehensive fleet solutions:

– Truck Masters Program (UK): 24/7 roadside assistance and mobile fitting

– Total Tire Care (North America): Lease, maintenance, and recycling services

– Telematics Integration: Combining tire data with fleet management systems

Market Competition

Hankook competes in a highly concentrated global market: Market Share of Major Players (Global TBR)

Major player | Market share |

1. Michelin | 18.2% |

2. Bridgestone | 15.7% |

3. Continental | 11.3% |

4. Goodyear | 9.1% |

5. Hankook | 5.2% |

6. Others | 40.5% |

Competitive Advantages

– Price/performance balance (15-20% below premium European brands)

– Rapid customization for regional market needs

– Strong Asian manufacturing base for cost efficiency

Industry Trends Impacting Strategy

Macro Factors

– Global truck tire market projected to grow at 5.8% CAGR (2025-2030)

– Asia-Pacific accounting for 42% of demand growth

– Increasing regulatory focus on fuel efficiency and sustainability

Technology Shifts

– Rise of intelligent tires with IoT connectivity

– Development of airless tire concepts

– Advancements in sustainable and recycled materials

Environmental Commitments

Hankook has implemented ambitious sustainability programs:

– Carbon Reduction: Targeting 50% reduction in manufacturing emissions by 2030

– Circular Economy: 40% recycled/rubber content in tires by 2030

– Energy Efficiency: 100% renewable energy at European plants by 2025

Expansion and Investment Plans

The company’s strategic roadmap includes:

– Capacity Growth: 15% increase in TBR production by 2026

– Market Expansion: Focus on Southeast Asia and Africa (targeting 8% market share)

– Product Development: Next-generation EV-specific truck tires

– Acquisitions: Potential targets in specialty tire segments

Financial Projections

Based on current trajectories (2025-2030):

– Revenue Growth: 6-8% CAGR in TBR segment

– Margin Improvement: 2-3% through operational efficiencies

– R&D Investment:

Maintaining 5% of revenue commitment

Hankook Tire has strategically positioned itself as a formidable competitor in the global truck tire market through continuous innovation, strategic manufacturing placement, and customer-focused solutions. While facing intense competition from established European and American brands, Hankook’s balanced value proposition, technological capabilities, and growing OEM partnerships provide a strong foundation for future growth. The company’s emphasis on sustainability and digital transformation aligns well with industry megatrends, suggesting continued market share gains, particularly in developing economies and emerging technology segments. With planned capacity expansions and product innovations, Hankook is well-positioned to potentially break into the top five global commercial tire manufacturers by 2030.

Mainsail brand Company Profile – MAINSAIL covers a range of SKid-steer tires, Backhoe loader tires, Mobile Excavator tires and AWP tires. SKS Tires 5.70-12 L5 5.90-15 L5 10-16.5 L5 12-16.5 L5 27×8.50-15 L5 Backhoe Loader Tires 14.9-24 16.9-24 16.9-28 17.5L-24 18.4-26 19.5L-24 21L-24 21L-24 Mainsail has strong technical force and can carry out the development […]

About the brand HAULMAX TIRE was established in 1927, it is one of the earliest rubber processing factories in China. From the early 1990, the company had been concentrating on research and developing of special use tires such as industrial tires, construction tires, port use tires, mining tires and so on. Now the products cover […]

Doupro brand is the best match of price and quality for TBR tires. Now, with 8 advanced production lines, its annual capacity is up to 4 million for TBR tires. Main Size: NO Size Ply-Rating Pattern Quantity/40HQ 1 6.50R16 12PR ST901 800 2 7.00R16 14PR ST901 700 3 7.00R16 14PR ST928 700 4 7.50R16 14PR …

Double coin TIRES In the 1830s, Wu Zhesheng, the founder of the Great China Rubber Factory decided the Double Coin trademark. It then made double coin tires become Chinese famous rubber tire.The factory established in the 1920s, and the company name was changed in 2017 to “Double Coin Tire Group Ltd “. “Double Coin” and “Warrior” …

With over half a century of experience behind them, MAXAM tires have built up an enviable reputation for quality, reliability and value and they are used by some of the world's largest mining operators. The tires are manufactured in state-of-the-art factories, using top quality materials and the latest equipment and technology.

Established in 2011, Ameristar brand has been welcomed by customers worldwide, mostly in North America, Asian, South America, Middle-east.

Prinx Chengshan is a leading tire manufacturer based in China, known for producing a diverse range of high-quality tires for different vehicles and purposes. Established in 1976, the company has steadily grown and expanded its presence both domestically and internationally.

Founded in 1975, Shandong Linglong Tyre Co., Ltd. is a specialized and large-scale technology-oriented tire manufacturer with leading products like high performance passenger car radial (PCR) tires, light truck radial (LTR) tires, all-steel radial truck and bus radial (TBR) tires, off-the-road (OTR) tires, agricultural(AGR) tires. Shandong Linglong Tyre Co., Ltd. is a Chinese leading tire […]

Giti Tire is a Singapore-based Global Tire Company offering a complete range of quality tires and services.The company provides tires to more than 130 countries and is ranked among the world’s largest tire companies.